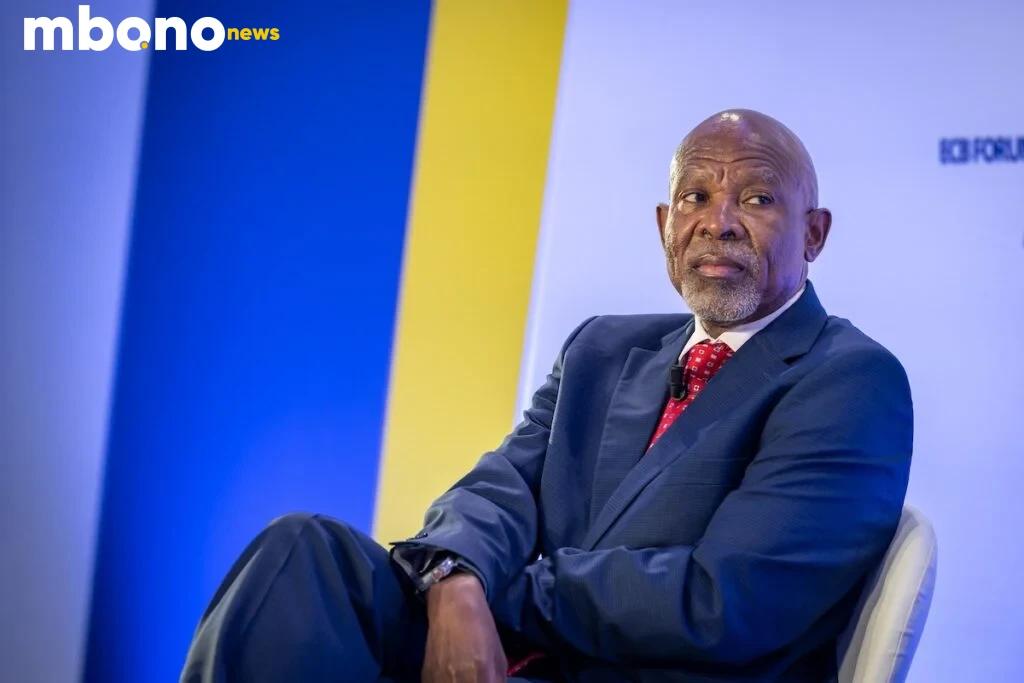

Pretoria, South Africa — South African Reserve Bank (SARB) Governor Lesetja Kganyago has announced a 25 basis point cut to the repo rate, bringing it down to 7.25%, effective Friday, 30 May. The decision was taken during the latest Monetary Policy Committee (MPC) meeting, held amid ongoing economic strain and slowing inflation.

🏦 Easing the Burden

The move signals a shift in the central bank’s policy tone, aiming to stimulate economic growth and ease financial pressure on consumers and businesses. South Africans can now expect slightly lower borrowing costs, with positive ripple effects across home loans, vehicle finance, and credit markets.

“This decision reflects the MPC’s assessment of improved inflation forecasts and the need to support a fragile economic recovery,” Kganyago stated during a press briefing.

📊 A Delicate Balancing Act

The rate cut comes as inflation shows signs of stabilizing within the SARB’s 3%–6% target band, while unemployment remains critically high and consumer confidence low. Analysts had been split ahead of the announcement, with some expecting a hold and others anticipating a more aggressive cut.

The SARB emphasized that further decisions would be data-dependent, particularly in light of global monetary trends and domestic fiscal risks.

💬 Market Reaction

Markets responded positively, with the rand showing modest strength and the JSE banking index ticking upwards. Economists welcomed the cut but warned that structural reforms, not just monetary tweaks, are needed to unlock South Africa’s long-term growth.