Pretoria, South Africa

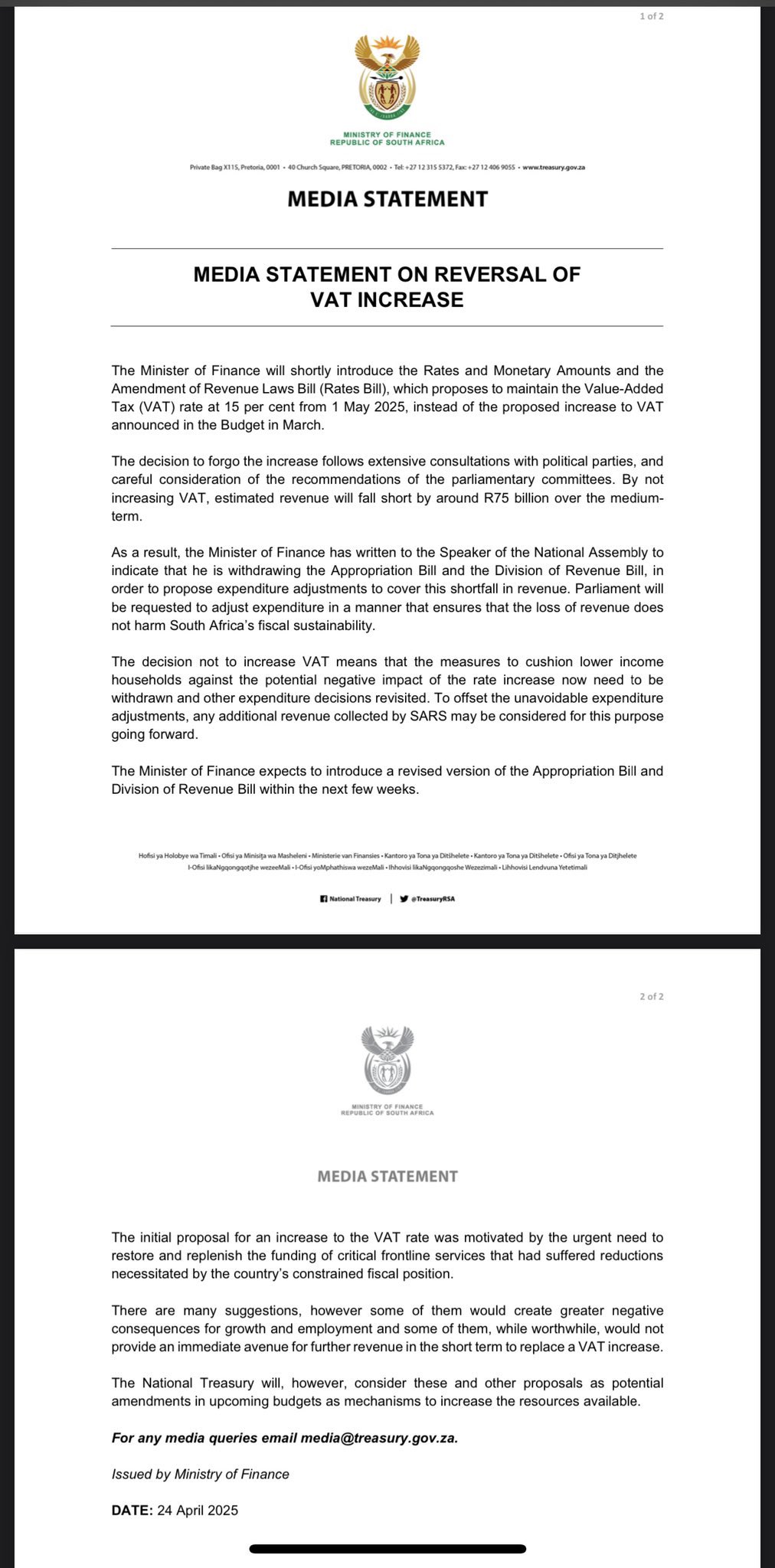

In a dramatic policy reversal, Finance Minister Enoch Godongwana has officially scrapped the 0.5% increase to South Africa’s Value Added Tax (VAT), which was due to take effect on May 1, 2025. The VAT rate will now remain at 15%, delivering a major win to both everyday South Africans and opposition parties who fought fiercely against the proposed tax hike.

The move comes after weeks of mounting pressure from the public, civil society, and political opponents — particularly the Democratic Alliance (DA) and Economic Freedom Fighters (EFF), both of whom launched legal challenges against the proposal.

A Quick Policy Reversal

The VAT hike was announced earlier this year as part of the government’s fiscal recovery plan to address a R32 billion budget shortfall. But almost immediately, the decision was met with resistance, with critics warning it would hit low- and middle-income households the hardest.

The Power of Public Pushback

What began as political opposition quickly turned into a nationwide debate, with citizens, consumer advocacy groups, and economic analysts warning of the inflationary impact of the increase. The DA and EFF, usually political rivals, found common ground in their fight to halt the VAT change — including preparing for a high-profile court showdown.

Today’s reversal signals just how powerful unified public pressure and legal threats can be in shaping national policy.

What This Means for You

- VAT remains at 15%, easing fears of rising costs in food, fuel, and essential goods.

- No immediate tax burden on consumers starting May 1.

- Political fallout likely to follow, as parties now jostle to claim credit for the U-turn.

A Tense Political Climate

The decision may have ended the VAT hike debate, but it opens a new one: how will the government plug the R32 billion gap now? And who truly influenced this reversal — the legal threat, the protest power, or quiet political negotiations behind the scenes?

Whatever the case, this is a major win for the people — and a major political moment for South Africa.