Fuel price hikes in South Africa for February are likely to be steeper than expected, driven by a combination of rising international oil prices and a weakening local currency. Recent data released by the Central Energy Fund (CEF) reveals a growing under-recovery for both petrol and diesel, with deficits widening daily as Brent Crude oil prices surge to near four-month highs.

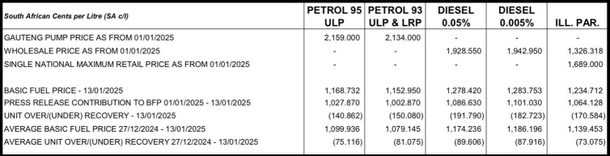

As of January 13, the CEF’s daily fuel price snapshot indicated an increase of 75 cents per litre for 95 Unleaded petrol and 81 cents for 93 Unleaded petrol. Diesel prices are expected to climb by 87 to 89 cents per litre, depending on the grade. However, with these deficits escalating, the final increase could easily exceed R1 per litre if current trends persist, marking a sharp reversal from recent improvements.

At present, 95 Unleaded petrol is priced at R20.80 along the coast and R21.59 inland, while 93 ULP stands at R21.34. Should the price hike surpass R1 per litre, much of the price relief seen in the second half of 2024 will be undone. For context, the coastal price of 95 ULP peaked at R24.70 in May 2024 and hit a low of R20.26 in October. These fluctuations underscore the volatility in fuel prices and the broader impact on consumers.

The steep price increase is being fuelled by a combination of factors, the most significant being the surge in global oil prices. Brent Crude has risen by nearly 10% since the beginning of 2025, surpassing $80 per barrel, its highest level in months. This price increase follows the tightening of global oil supply, especially due to US sanctions on Russian crude, which could remove up to 800,000 barrels per day from the market. Experts suggest that these sanctions, along with resilient US economic data, are driving upward momentum in oil prices.

Meanwhile, the local currency has exacerbated the problem. The rand, which averaged R18.11 to the dollar in December, has weakened further in January, crossing the R19 mark late last week. The drop in the rand against the US dollar adds significant pressure on fuel prices, as South Africa imports most of its fuel.

With these developments in mind, the outlook for February is grim. Consumers can expect a substantial increase in the cost of fuel, which will have a ripple effect on transport, goods, and services, putting further strain on household budgets already stretched by inflation. Given the unpredictability of both international oil prices and the local currency, South Africans will likely face higher fuel costs for the foreseeable future, with no immediate relief in sight.